You Might Be Taxed More Than You Think in Retirement

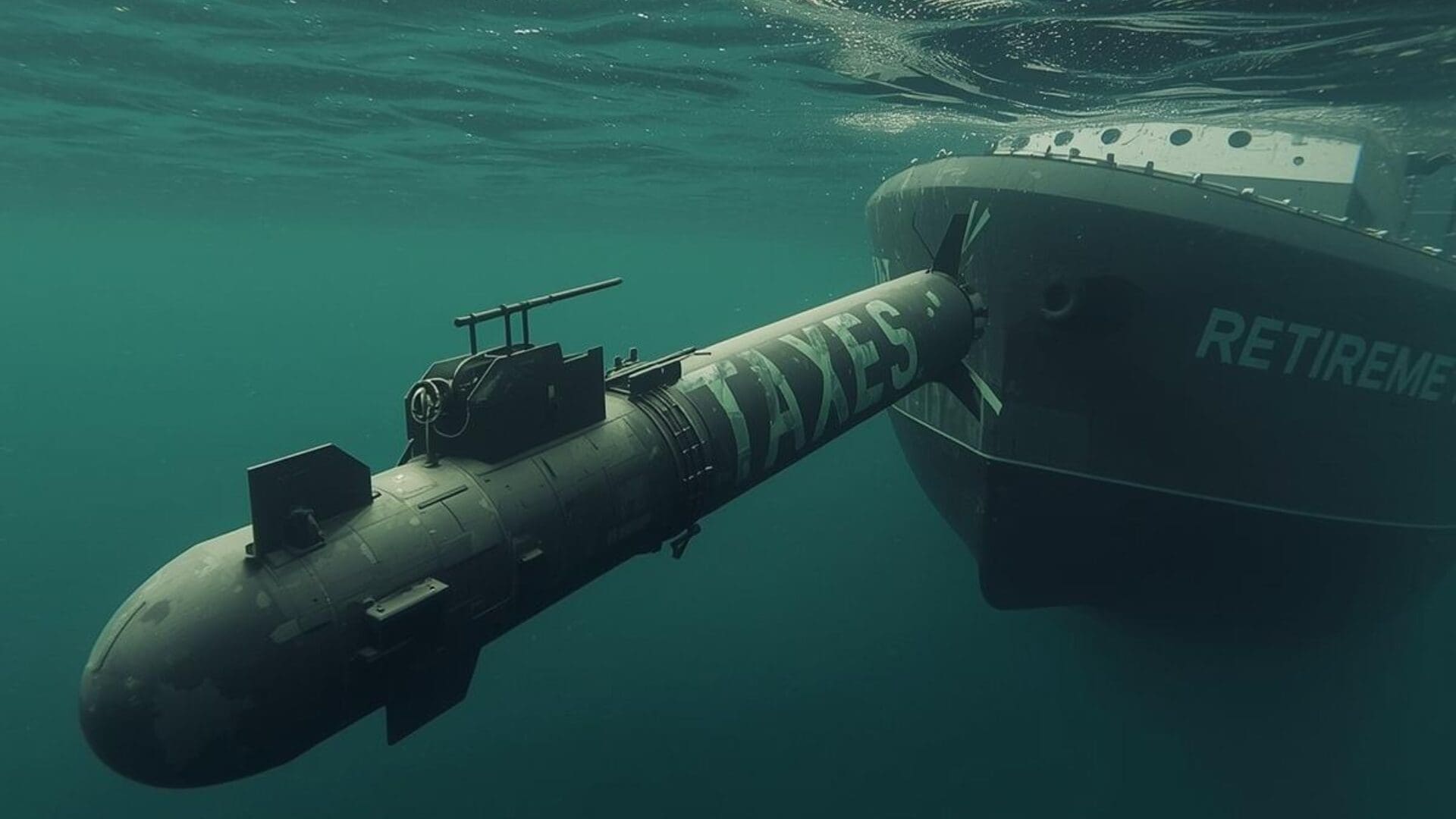

Most retirees expect their tax bill to go down once they stop working—but thanks to something called the “Tax Torpedo,” that’s not always the case. This sneaky tax hit can cause your Social Security benefits to become taxable, unexpectedly increasing your overall tax burden.

If you’re not careful with how you withdraw income from IRAs, 401(k)s, or other sources, you could trigger this torpedo and lose thousands in unnecessary taxes over your retirement.

What Is the Tax Torpedo?

The Tax Torpedo refers to the sharp increase in marginal tax rate that can occur when your income causes your Social Security benefits to become taxable. Up to 85% of your Social Security income can be taxed—not at a flat rate, but on a sliding scale based on your provisional income.

Provisional income includes:

- Your adjusted gross income (AGI)

- Tax-exempt interest (like municipal bond income)

- Half of your Social Security benefits

Once your provisional income exceeds certain thresholds, more of your benefits become taxable—and your effective tax rate can spike suddenly, like a torpedo hitting your wallet.

For 2024, these are the key thresholds:

- Single filers: Taxation begins at $25,000

- Married filing jointly: Taxation begins at $32,000

These limits aren’t indexed for inflation, meaning more retirees are affected each year.

How the Tax Torpedo Affects Your Retirement Income

Here’s why it’s so dangerous: As you cross those provisional income thresholds, every additional dollar you withdraw from a retirement account can cause up to $1.85 in total income to become taxable. That’s a brutal tax hit—especially for retirees on a fixed income.

This can:

- Inflate your tax bracket far beyond what you expected

- Reduce the net value of your retirement withdrawals

- Lead to IRMAA surcharges (higher Medicare premiums)

- Eat into your savings faster than planned

Strategies to Avoid or Minimize the Tax Torpedo

The best way to defuse this tax trap is to create a tax-efficient income plan that coordinates how and when you take income from various accounts.

Smart strategies include:

- Roth conversions in early retirement to reduce future IRA withdrawals

- Delaying Social Security while drawing from IRAs first

- Tapping taxable brokerage accounts (with long-term capital gains) for flexible, lower-tax income

- Spreading out large distributions to stay under key thresholds

A personalized withdrawal sequence can keep more of your Social Security benefits tax-free—and more money in your pocket.

Let’s Build a Tax Plan That Protects Your Benefits

At Heritage Financial Planning, our HFP S.T.A.R. Strategy (Seasonal Transition into Advanced Retirement) is built around optimizing your retirement income in all its forms—especially Social Security. We’ll help you identify whether you’re at risk of triggering the Tax Torpedo and build a withdrawal strategy to help avoid it.

Schedule your Social Security tax strategy session today and turn your income into opportunity—not extra taxes.

Click here to learn more about our HFP STAR Strategy process.

Sources:

- IRS: Social Security Benefits and Taxes – https://www.irs.gov

- Social Security Administration – https://www.ssa.gov

- AARP: How the Tax Torpedo Works – https://www.aarp.org

- Heritage Financial Planning: https://heritagefinancialplanning.net/about/heritage-financial-star-strategy/