The vital role of inflation in financial planning for children’s college expenses.

In today’s rapidly changing economic landscape, proper financial planning has become more critical than ever. When it comes to saving for children’s college expenses, accounting for inflation is a fundamental aspect that cannot be overlooked.

Inflation, the gradual increase in the cost of goods and services over time, can erode the purchasing power of your money if not factored into your financial strategy.

Rising Costs of College vs. Inflation

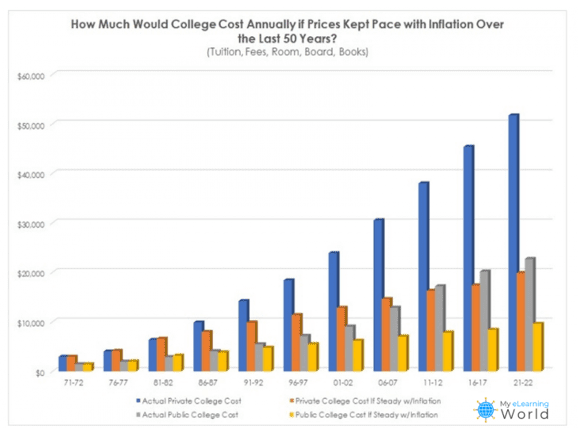

Did you know that in 1980, the price to attend a four-year college full-time was $10,231 annually – including tuition, fees, room and board, and adjusted for inflation – according to the National Center for Education Statistics? By 2019-20, the total price increased to $28,775. That’s a staggering 180% increase.

But let’s look at it another (and more sobering way):

If the cost of going to college increased consistently with the U.S. inflation rate over the last 50 years, students today would be paying between $10,000 to $20,000 per year to attend public or private universities.

The Inflation Challenge

Inflation is a natural economic phenomenon that affects virtually every aspect of our lives. From groceries to healthcare to college costs, living costs tend to rise over time.

If not addressed in your financial planning, inflation can profoundly impact your savings’ ability to cover future expenses. Given the long-term nature of the goal, this is particularly relevant when it comes to saving for children’s college education.

Preserving Purchasing Power

Imagine you start saving for your child’s college education when they are born. Over the next 18 years, you diligently save a significant amount. However, if inflation averages around 3% per year, the cost of college education could easily double during that time. Without accounting for inflation, you might find that the money you’ve saved falls way short of covering the actual expenses when your child is ready to enroll.

By accounting for inflation, you ensure that the purchasing power of your savings remains intact.

You are essentially future-proofing your investments, allowing them to maintain their value over time. This safeguards your ability to meet rising expenses without compromising the quality of your child’s education.

Realistic Goal Setting

Incorporating inflation into your financial planning helps set realistic goals. When planning for a future expense like college, it’s essential to understand the true cost. Ignoring inflation can lead to underestimating the required savings amount, potentially causing stress and financial strain in the long run.

When you accurately account for inflation, you gain a more accurate understanding of the amount you need to save to cover college expenses. This empowers you to allocate your resources effectively, thereby minimizing the risk of falling short and maximizing the chances of achieving your goals.

The Power of Compounding

Compound interest is a powerful force in wealth accumulation. When you invest your savings, they have the potential to grow over time. However, if you fail to account for inflation, your investment returns might not keep pace with rising costs.

Inflation-adjusted returns are crucial to ensure that your investments genuinely generate wealth and provide the returns you need to meet your financial goals.

Mitigating Financial Stress

One of the primary purposes of financial planning is to alleviate financial stress and provide peace of mind. Inflation, when unaccounted for, can disrupt this objective. Unexpectedly high costs can lead to last-minute financial scrambling, potentially forcing you to compromise on the quality of your child’s education or take on substantial debt.

By accounting for inflation, you adopt a proactive financial planning approach. You are preparing for the future’s uncertainties and ensuring that your child’s educational aspirations are not compromised due to financial constraints.

Planning Matters

Financial planning is a holistic process that requires careful consideration of various variables, with inflation being critical. When saving for children’s college expenses, it’s vital to factor in inflation to preserve the purchasing power of your money, set realistic goals, harness the power of compounding, and mitigate potential financial stress.

By incorporating inflation into your financial strategy, you are taking a proactive step toward securing your child’s education and your family’s financial future. With our HFP S.T.A.R. Strategy process, we take you through a complete step-by-step approach to designing and implementing a customized financial plan consisting of income planning, “age-appropriate” investment strategies, tax planning and positioning, health care strategies, and legacy planning.

Click here to learn more about our HFP STAR Strategy process.

Remember, time is on your side, and early, informed financial decisions can make all the difference in achieving your goals. Call our office at (574) 606-4406 to schedule an appointment.

Source: Copyright © 2023 FMeX. All rights reserved. Distributed by Financial Media Exchange