Failing to raise the ceiling by June 1st could lead to short-term challenges.

The debt ceiling, a crucial aspect of fiscal policy, has long been a subject of debate and concern within the United States. As the nation grapples with the possibility of not raising the debt ceiling by June 1st, it is essential to understand the historical context and potential consequences.

And there are five asset classes that might face short-term struggles in the event of a failure to raise them.

The Evolution of the Debt Ceiling

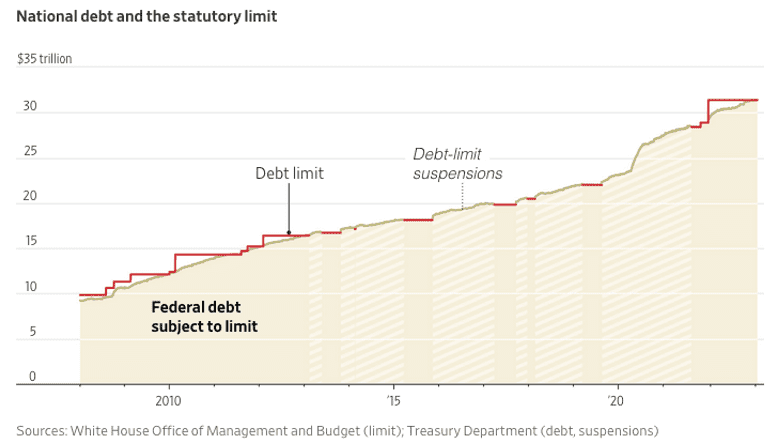

The debt ceiling was first introduced in 1917 under the Second Liberty Bond Act, granting the U.S. Treasury authority to issue debt up to a specific limit set by Congress. Initially intended as a mechanism to finance World War I, the debt ceiling has since become a recurring point of contention during times of economic uncertainty.

Throughout its history, the debt ceiling has been raised numerous times to accommodate increasing levels of national debt. Political debates surrounding the ceiling have become more contentious over the years, often leading to high-stakes negotiations and the potential for adverse economic consequences if the limit is not raised in a timely manner.

Asset Classes at Risk

-

U.S. Treasury Bonds and Notes: U.S. Treasury bonds and notes are considered among the safest investments globally, as they are backed by the full faith and credit of the U.S. government. However, failure to raise the debt ceiling could result in delayed or reduced interest payments, causing investors to question the creditworthiness of these securities. This uncertainty may lead to increased yields and decreased demand for Treasury bonds and notes.

-

U.S. Dollar: A failure to raise the debt ceiling could erode global confidence in the U.S. dollar as a stable reserve currency. The potential downgrade of the U.S. credit rating could lead to a depreciation of the dollar against other major currencies, impacting international trade, import costs, and inflation.

-

Stock Market: The stock market could experience increased volatility and potential sell-offs if the debt ceiling is not raised promptly. Heightened uncertainty about the stability of the U.S. economy could lead to investor caution and reduced corporate earnings expectations, affecting stock prices across various sectors.

-

Mortgage-Backed Securities (MBS): Mortgage-backed securities, which are bundles of home loans packaged and sold to investors, may face challenges if the debt ceiling is not raised. A volatile market could result in higher borrowing costs and interest rates, making it more difficult for individuals and businesses to obtain affordable financing, thereby impacting the housing market.

-

Commodity Markets: The uncertainty surrounding the debt ceiling may also impact commodity markets. A weaker dollar, caused by the potential failure to raise the debt ceiling, could increase the prices of commodities denominated in U.S. dollars, such as oil, metals, and agricultural products. This could affect industries reliant on these commodities, potentially leading to higher production costs and reduced profitability.

What Investors Should Do

The debt ceiling has been an integral part of U.S. fiscal policy for over a century, with its implications extending beyond government finances to various asset classes and the broader economy. But failing to raise the debt ceiling by June 1st could lead to significant short-term challenges for several asset classes.

It is important to note that while these asset classes may face immediate struggles, the long-term impact will depend on how quickly and effectively policymakers address the debt ceiling issue. Timely resolution and responsible fiscal management will be key to maintaining confidence in the U.S. economy and minimizing potential disruptions to these asset classes and overall financial stability.

As always, Heritage Financial Planning is here to help you with any questions or concerns relating to your financial planning and future. If you feel uncertain about what steps to take for your financial well-being in current market conditions, don’t hesitate to reach out and contact us today for information or an appointment. We are confident that together we can find viable solutions for a healthy financial system now and into the future. In fact, with our HFP S.T.A.R. process, you’ll be guided through every crucial step to secure your financial future for a peaceful retirement.

Click here to learn more about our HFP STAR Strategy process.

Don’t leave your hard-earned work to chance. Let us help you secure the golden years you deserve. Contact our office to get started!

Source:

Copyright © 2023 FMeX. All rights reserved. Distributed by Financial Media Exchange.