Suppose your traditional IRA is invested in stocks and/or mutual funds. In that case, the stock market’s recent downward slide may provide a unique opportunity to convert your traditional IRA to a Roth IRA at a low cost and benefit when the markets recover.

Why would you want to do that? Because Roth IRA distributions provide tax-free retirement benefits, while payouts from Traditional IRAs are taxable.

Of course, there is no assurance that the markets will not continue to decline, and this may not be the most suitable time to make a conversion in your specific circumstances, but it is something you may want to consider. Conversions provide the most benefit to younger individuals looking forward to many years of the tax-free growth a Roth IRA provides.

You can convert only some of your traditional IRA in one year. You can convert what you can afford to pay the tax each year.

Here Is How It Works – The tax code allows individuals to convert any portion of their traditional IRA to a Roth IRA by paying tax on the conversion as though taking a distribution from the conventional account. Thus, if you make a conversion, you are taxed on the conversion based on the tax rates that apply to your regular income plus the traditional IRA amount being converted.

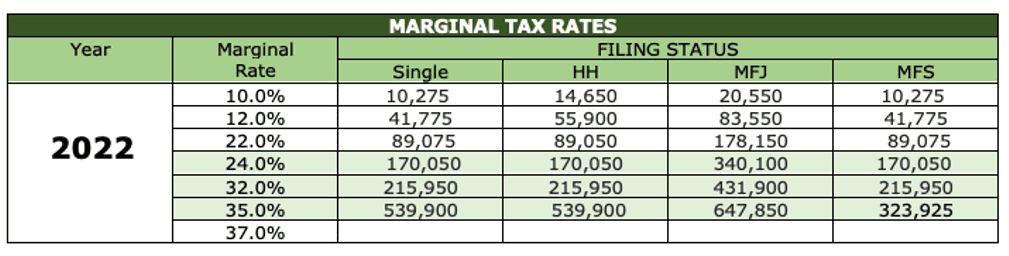

Of course, if in 2022 you have an abnormally lower income, that could make the conversion tax even less. The table below includes the marginal tax rates for 2022.

Example When Using the Table – Let’s say you are filing single and your taxable income without an IRA conversion amount is $45,000, which has a marginal rate of 12%, and you are converting $40,000. This brings your taxable income to $85,000, which is still in the 12% bracket (more than $41,775 but less than $89,075, the start of the next rate). This means the tax on the conversion would be $4,800 (12% of $40,000). If you did the conversion in a year when your other income was more, and when combined with the conversion amount, you are in the 22% bracket, the tax on the conversion would be $8,800, $4,000 more than when you are in the 12% bracket.

Other Issues:

- There is no income limitation on making a conversion; thus, anyone can do a conversion.

- Higher-income taxpayers can use the conversion to circumvent the AGI limits for contributing to a Roth IRA.

- Once a conversion is made, it cannot be undone.

- Some individuals, for various reasons, have made non-deductible contributions to their traditional IRAs. For distribution or conversion purposes, all an individual’s IRAs (except Roth IRAs) are considered as one account, and any distribution or converted amounts are deemed taken ratably from the deductible and non-deductible portions of the traditional IRA. The piece that comes from the deductible contributions would be taxable.

Given the current market conditions, it may be an opportune time to convert your traditional IRA. to a Roth IRA. Schedule an appointment today to learn more about how you can take advantage of this opportunity. Our team of experts will work with you one-on-one to create a personalized HFP S.T.A.R. Strategy Plan that considers your financial situation and helps you reach your long-term goals.

Click here to learn more about our HFP STAR Strategy process.

Our HFP S.T.A.R. Strategy process is designed with one goal: your financial future. We’ll walk through all the necessary preparations and explain what’s happening along every stage of this process. Call our office at (574) 606-4406 to get started.