A traditional path to building wealth, it is more difficult for younger buyers.

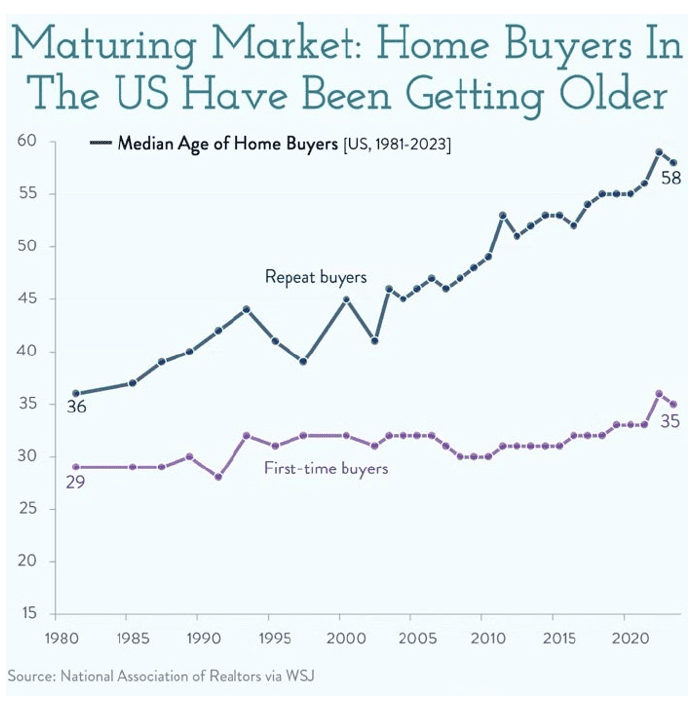

It used to be that a housewarming party meant a new couple or young family welcoming friends to a freshly purchased home, complete with the traditional gift of a wooden salad bowl. Today, however, the housing market has drastically changed, and younger generations are increasingly left out. The latest data from the National Association of Realtors highlights a growing trend: first-time homebuyers are older and wealthier than ever, and fewer of them are buying homes compared to previous decades.

The Renter Generation

In 2024, the median age of first-time homebuyers in the United States has climbed to an unprecedented 38 years, up from 35 just a year earlier. The overall median age of homebuyers has also increased, from 49 to 56 years. This age jump underscores the barriers young people face in entering the housing market. In fact, less than a quarter of homes sold in the past year went to first-time buyers, marking the lowest level in over 40 years. Housing affordability has become a critical topic in the 2024 presidential race, and the latest data adds urgency to a growing sense that the American dream of homeownership is slipping away for younger generations.

Older & Wealthier Dominates the Market

Affordability constraints have made homeownership a privilege increasingly reserved for the affluent. First-time buyers now boast a median income of $97,000, and their down payments have reached 9% of home value – levels not seen in more than 25 years. Repeat buyers are wealthier still, with nearly a third of them paying for homes entirely in cash. As older, richer buyers dominate, younger adults find it harder to save up or qualify for the necessary mortgages to compete in today’s expensive housing market.

A Growing Racial Gap

Homeownership in the U.S. remains racially inequitable, and this gap widened over the past year. Eighty-three percent of homebuyers identified as white, up from 81% last year. Still, there are some encouraging signs: over a third of first-time homebuyers identified as non-white, indicating a gradual change in the racial composition of younger homeowners.

However, systemic and financial obstacles continue to disproportionately affect minority buyers, making it harder for them to close the gap.

Housing Woes and Political Promises

September saw existing-home sales plummet to a 14-year low, while home prices hit a monthly record with a median of $404,000. This environment leaves young Americans – many of whom are struggling under the weight of student loans and stagnant wages – feeling shut out from the benefits of homeownership. Acknowledging this critical issue, both major presidential campaigns have put forward solutions aimed at wooing young voters.

Vice President Harris has proposed a plan to build three million new housing units, alongside a $40 billion fund to spur local construction projects. She’s also suggested up to $25,000 in down payment assistance for eligible first-time buyers. Meanwhile, former President Trump has outlined a vision to open up federal lands for housing development, roll back regulations to simplify building, and bring down mortgage rates – though the feasibility of a president directly lowering interest rates is limited.

Wealth Gap Between Owners and Renters

The takeaway from all of this is that homeownership remains one of the most significant paths to building wealth in America. In 2022, the median wealth gap between homeowners and renters reached $390,000. While renting is often more affordable month to month, renters miss out on equity gains and the long-term financial benefits of rising property values. For those who aspire to build generational wealth, owning a home is more crucial – and more expensive – than ever.

For now, many young people remain stuck on the sidelines of the housing market, watching from afar as property prices continue to surge. With political promises swirling, the question remains: Will any of these solutions make a meaningful impact, or will younger generations continue to be boxed out of homeownership? Only time will tell.

How Heritage Financial Planning Can Help

Navigating the complexities of today’s housing market requires more than just perseverance—it demands a well-crafted financial strategy. At Heritage Financial Planning, our HFP S.T.A.R. Strategy is designed to help you identify your financial goals, analyze your options, and create a personalized plan to turn aspirations like homeownership into reality. Whether you’re saving for your first home or seeking to optimize your wealth-building journey, our team is here to guide you every step of the way. Contact our office today to schedule an appointment and take the first step toward securing your financial future.

Click here to learn more about our HFP STAR Strategy process.

Source: Copyright © 2024 MainStreet Journal. All rights reserved. Distributed by Financial Media Exchange.