Understanding long-term capital gains taxes when you sell investments.

Market downturns, like the one through 2022, could be a good time to adjust your fund portfolio to minimize the tax bite. Here’s how to calculate the best ways to do that – now and in the future.

Taxable accounts you hold longer than a year incur long-term capital gains taxes when you sell investments. You realize losses or gains, meaning your losses are subtracted from the gains, and if the result is positive, your gains are taxed at the preferable long-term capital gains rates (a rate often much less than ordinary income tax rates).

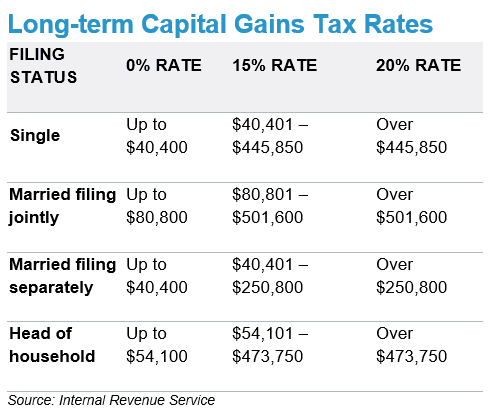

The rates range either 0%, 15%, or 20%, depending on your income.

Trimming Taxes

When your losses exceed your gains, your capital gains are netted against the losses, and the losses are subtracted from the gains. In this manner, your gains incur no tax. If your losses exceed gains, you can use the excess to reduce your ordinary income to $3,000 per year ($1,500 if filing separately), carrying over any remaining losses to future years.

Let’s say your four taxable accounts (A, B, C, and D) each have a cost basis (what you paid for the fund originally) of $10,000.

- Fund A’s current value is $15,000, and it gained $5,000

- Fund B’s current value is $20,000, and it gained $10,000

- Fund C’s current value is $8,000, and it lost $2,000 and

- Fund D’s current value is $4,000, and it lost $6,000.

As is, you net $7,000 (your gains of $5,000 plus $10,000, minus your losses of $2,000 and $6,000).

You can sell various combinations of your funds’ holdings for the best tax advantage. Selling all of funds A (which had a gain of $5,000) and D (loss of $6,000) nets you a long-term capital loss of $1,000. If this is your only activity in long-term holdings for the year, you owe no capital gains, and you realize $1,000 in losses to use to reduce your income.

What if you sell just 80% of your fund B, meaning $8,000 in gain? Then you sell all of both funds C and D, which combined lost $8,000? The result: zero capital gains and zero capital gains tax.

This last example is the least efficient way to use your losses. Always attempt to maximize the amount you can use against ordinary income, resulting in the greatest tax reduction. If you sell all of funds A, C, and D, for instance, you get a capital loss of $3,000 ($5,000 minus $2,000 minus $6,000) that you can use to offset income this year and potentially in future years.

These strategies become even more important with larger holdings and if you have funds that rebound in value in the future.

Social Security and Other Tax Issues

Be careful with your capital gains. For instance, a gain taxed at even the 0% rate can increase your adjusted gross income, increasing taxes on your Social Security income.

Also, use care after you sell a holding that recognized a loss. If you look to better your tax situation in the future with the same or a substantially similar asset, you need to wait at least 30 days before you buy. Otherwise, you trigger a wash sale treatment, which, according to the Internal Revenue Service, effectively eliminates that loss for tax purposes.

Why Choose Heritage Financial Planning

Taking the proper steps, understanding different tax implications, and utilizing the right tools can help you dramatically minimize your overall taxes, not just during market downturns but also for other tax issues like Social Security. Heritage Financial Planning is here to provide you with an array of practical strategies to manage your taxes and investments. Our HFP S.T.A.R. Strategy process is tailored specifically to each client in order to provide the most effective and efficient tax minimization possible.

Click here to learn more about our HFP STAR Strategy process.

In fact, our HFP S.T.A.R Strategy process takes you through a complete step-by-step holistic approach to designing and implementing a customized financial plan consisting of income planning, “age-appropriate” investment strategies, tax planning & positioning, health care strategies, and legacy planning. So don’t wait – contact our office to schedule an appointment to get your custom HFP S.T.A.R Strategy now.

Source: Copyright © 2023 FMeX. All rights reserved. Distributed by Financial Media Exchange