Investors should remain agile and watch economic indicators and trends.

In a twist that has left many investors and analysts scratching their heads, gold has recently embarked on an unexpected rally, despite the traditional view of the precious metal as a safe haven during periods of economic uncertainty and geopolitical turmoil. This rally has unfolded against a backdrop of widespread optimism regarding the U.S. economy, which has buoyed riskier assets such as stocks to new heights and even propelled Bitcoin to surpass its previous records.

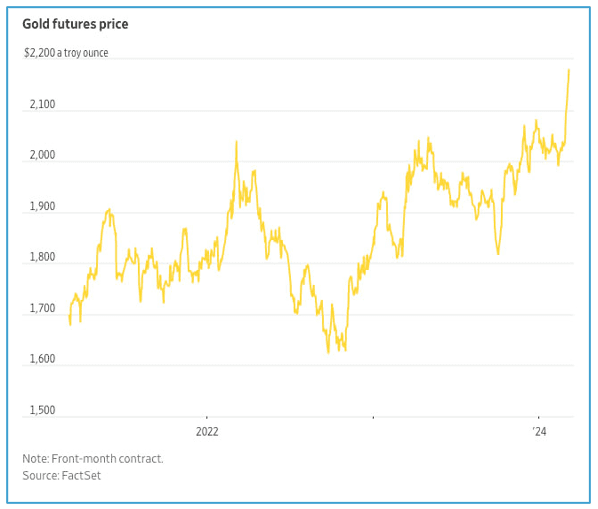

Over eight trading sessions in mid-March, for example, gold futures consistently notched gains, with futures for March delivery hitting a record high of $2,182.50 a troy ounce on Monday, March 11th, marking a significant 5.8% increase in gold’s value this year.

Rates Coming Down in 2024

This surge in gold prices comes in the wake of a dip in consumer sentiment and the release of moderate inflation data last month, which has fueled speculation that the Fed may lower interest rates within the year. Such a move would enhance the appeal of gold, which does not generate income, especially when compared to dividend-yielding stocks and interest-paying bonds.

However, the scale of gold’s ascent necessitates a deeper exploration beyond the immediate economic indicators and interest rate expectations.

Notably, gold has recorded a 20% gain since the end of 2021, a period during which the Fed’s aggressive stance on inflation has driven real yields – that is, interest rates adjusted for inflation – from approximately negative 1% to about 1.8%. This increase in real yields would typically deter gold investment, as it makes yield-bearing assets more attractive by comparison. Indeed, this rise in real yields has been accompanied by a significant sell-off in U.S. gold ETFs.

Remain Agile

For investors, the current gold rally underscores the complexity of financial markets, where multiple factors can drive asset prices in ways that may not initially seem intuitive. While the allure of gold as a safe haven remains a cornerstone of its appeal, the dynamics of its recent rally highlight the importance of considering a broader array of economic indicators, market sentiment, and geopolitical factors when evaluating investment opportunities.

As the situation evolves, investors would do well to remain agile, keeping an eye on both traditional economic indicators and broader market trends. The unexpected gold rally serves as a reminder of the market’s unpredictability and the need for a diversified investment strategy that can adapt to changing conditions.

At Heritage Financial Planning, this principle lies at the heart of our proprietary HFP S.T.A.R. Strategy process, which forms the cornerstone of crafting your custom retirement plan.

Click here to learn more about our HFP STAR Strategy process.

By leveraging this strategy, we can navigate market fluctuations with confidence, ensuring your financial goals remain within reach. Take the first step towards securing your financial future by scheduling an appointment with our office today. Let’s embark on this journey together towards a prosperous retirement.

Source: Copyright © 2024 FMeX. All rights reserved. Distributed by Financial Media Exchange.